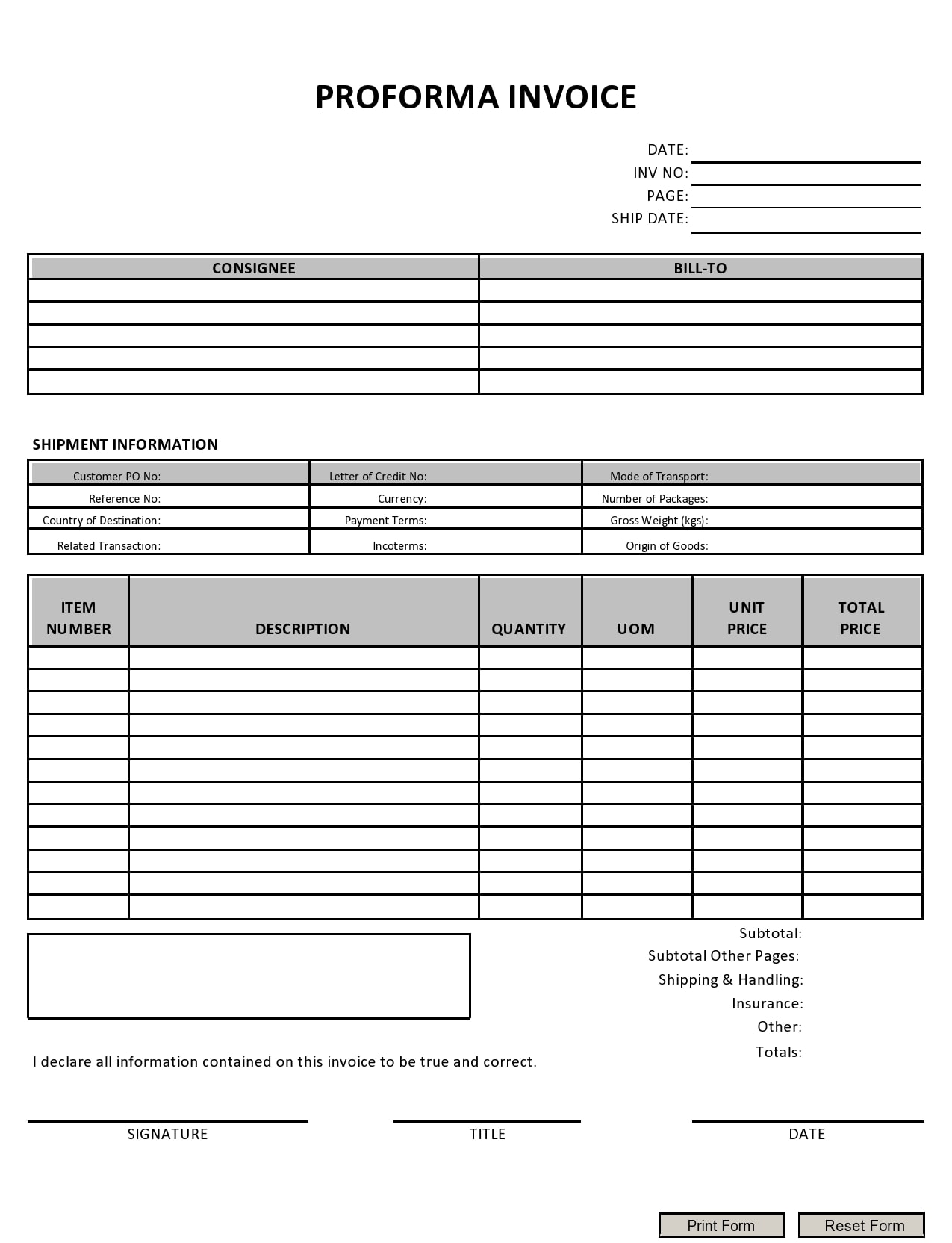

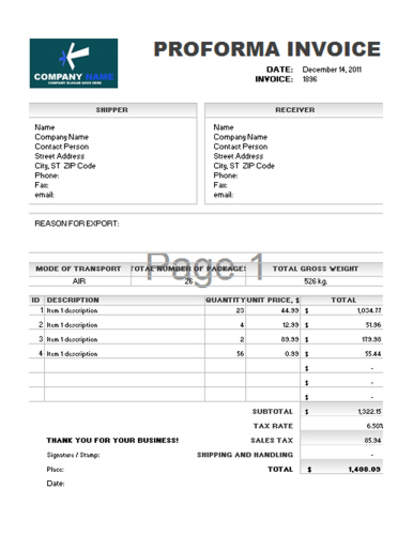

Enter your business name, address and at the bottom complete the payments section.

Insert your company logo, if you have one, or delete the message.Download the template at the bottom of this article.

Proforma invoice example how to#

How to use the Free Proforma Invoice Templateįollow these instructions to get started with our free proforma invoice template: The template will automatically calculate the VAT. It allows you to set up a template to include your business information and logo. Our free Excel Proforma invoice template UK is available to download at the end of this article. If a business uses the VAT cash accounting scheme, it can only claim the VAT when money is paid or received. It is also essential to reclaim VAT in the correct period and the date the transaction took place as a customer. You must issue VAT invoices within 30 days of the date the transaction took place. You should not delay the invoice until payment is received, as it might be a couple of months later. Once a transaction takes place, a VAT invoice should be issued and include the tax date.

It is a large order, and you require partial payment upfront.The customer is new, and you require payment in advance.There are a few reasons you may decide to issue proforma invoices.

Proforma invoice example pro#

0 kommentar(er)

0 kommentar(er)